In the previous article, FDI explored CBAM (Carbon Border Adjustment Mechanism) the European Union’s measure to address climate change. This mechanism will officially take effect in January 2026, covering the first six product categories: cement, electricity, fertilizers, iron and steel, aluminum, and hydrogen. Importers will be required to purchase CBAM Certificates based on the quantity of imported goods and the amount of carbon emissions associated with similar products produced within the EU. The higher the emissions, the higher the cost which in turn raises product prices. In this article, we will further examine and clarify what the CBAM Certificate is, what importers outside the EU need to do, and which products will be included in the next phase of carbon adjustment before crossing borders.

What is a CBAM Certificate?

A CBAM Certificate is a permit that importers of goods from outside the European Union (EU) must purchase to demonstrate that they have paid a “carbon fee” corresponding to the amount of greenhouse gases emitted during the product’s manufacturing process. It is part of the CBAM (Carbon Border Adjustment Mechanism) the EU’s “carbon border tax” aimed at preventing carbon leakage, which occurs when companies within the EU relocate high-emission production to countries with less stringent environmental regulations to reduce costs, then re-import those products back into the EU. This measure ensures stricter control over such practices and promotes fair carbon cost alignment between imported goods and those produced within the EU.

The CBAM mandatory regulation will officially take effect on January 1, 2026.

In the first phase, there will be six product categories: cement, electricity, fertilizers, iron and steel, aluminum, and hydrogen, including certain downstream products related to these main categories such as nuts and bolts which will also be required to purchase and submit CBAM Certificates** based on the amount of embedded emissions** in the imported goods.

.The Stock Exchange of Thailandhas provided insightful information stating that, for imports, the importer or operator (such as Thai exporters) must appoint an authorized CBAM Authorized Declarant responsible for importing goods subject to CBAM regulations into the EU customs territory. Importers or exporters are required to submit a CBAM Declaration to report the amount of greenhouse gas emissions embedded in their products, known as Embedded Emissions. These values are used to calculate the corresponding carbon cost. (Currently, Thailand reports carbon data through the Carbon Footprint system rather than the Embedded Emissions system.) Afterward, authorities will request the CBAM Certificate, which serves as proof of carbon payment. If the certificate is not provided, the carbon cost will be charged based on the exporting country, and additional penalties may apply. In the future, the list of regulated products under CBAM may expand beyond the current categories.

How is Thailand preparing to handle the mandatory CBAM Certificate implementation in 2026 ?

The Thailand Greenhouse Gas Management Organization (Public Organization) (TGO) a government agency responsible for managing and reducing greenhouse gas emissions in Thailand, has developed an Embedded Emissions reporting system. This system focuses on measuring both direct and indirect greenhouse gas emissions generated during production processes to align with the CBAM framework.In addition, TGO is negotiating with the European Union to allow Thailand to use carbon credits from T-VER projects Thailand’s voluntary greenhouse gas reduction program as a substitute or offset to reduce the burden of purchasing carbon costs or CBAM Certificates.

The EmbeddedEmissions report must be submitted annually on May 1 of each year, with the first submission in 2027, using data from 2026 for calculation. The verification of this data must be conducted by verifiers or verification bodies accredited by EU Accreditation Bodies.

Will there be more product categories added in the future?

There may be an expansion of product categories, especially in industries at risk of production base relocation, such as organic chemicals and polymers.

CBAM Consulting Service

Consulting services provided by experts in calculating greenhouse gas emissions (Embedded Emissions) and preparing reports in compliance with EU regulations enhancing competitiveness, reducing trade barriers, and giving your organization greater confidence.

- Consultation services on CBAM standards and regulatory requirements

- In-house practical training services to enhance knowledge and understanding for report preparation

- Design greenhouse gas reduction plans in compliance with European Union standards

- Calculate the greenhouse gas emissions of products and prepare CBAM documentation and reports

FDI Consultant for Organizational and Product Carbon Footprint

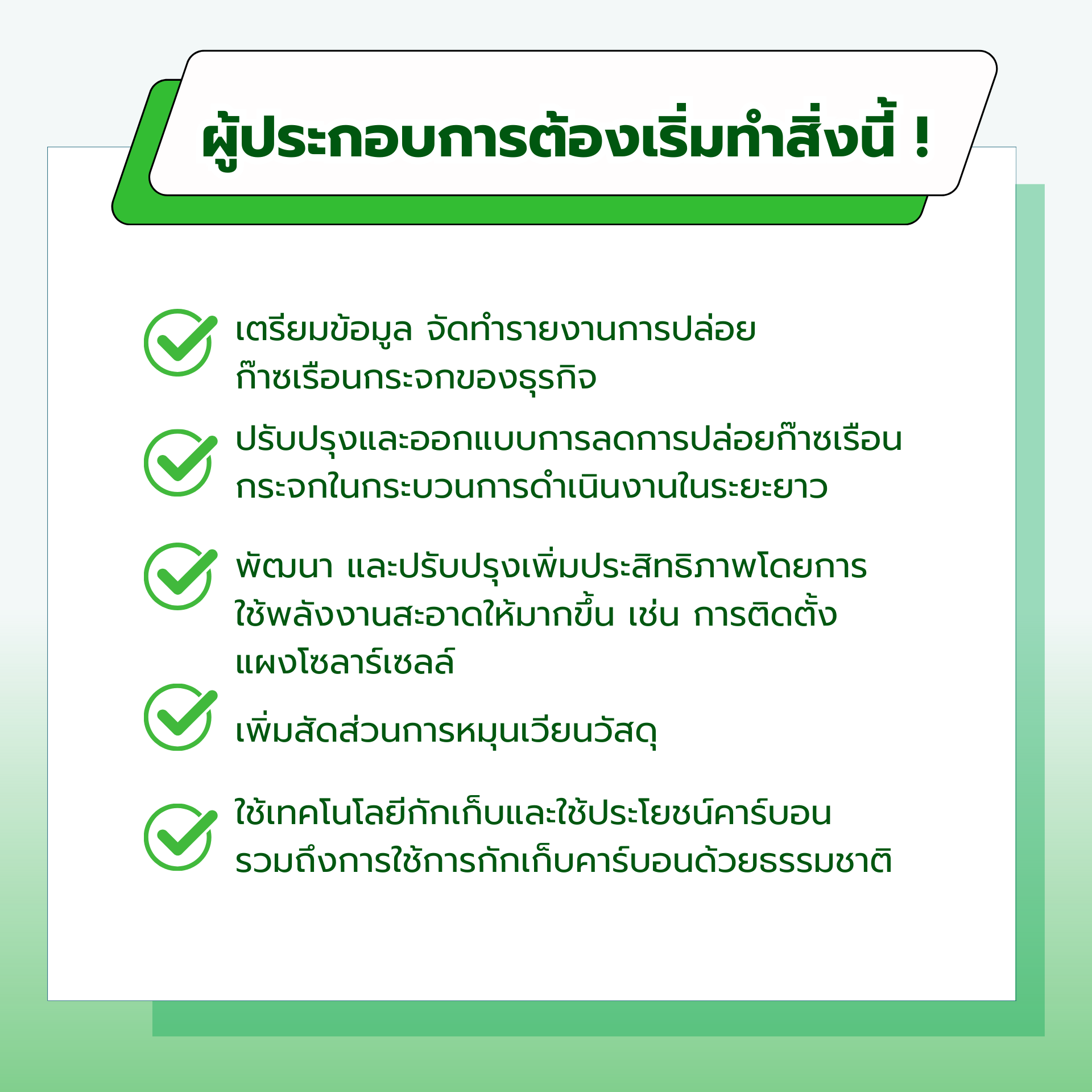

In summary, business operators must begin collecting data to assess the carbon emissions of their organizations and products. They can consult with FDI, which provides advisory services for organizations and manufacturers across all industries. FDI offers both consulting and in-house workshop services, guiding clients in preparing data for the assessment of the Carbon Footprint for Organization (CFO) and the Carbon Footprint of Products (CFP) — including data collection, analysis, and calculation of carbon footprints in accordance with greenhouse gas accounting standards. The assessments follow both national and international standards, such as TGO, GHG Protocol, PCAF, and IPCC, along with professional guidance for carbon label registration certified by the Thailand Greenhouse Gas Management Organization (TGO).

FDI began providing consulting services to various companies and launched its environmental consulting services in 2023. Since then, FDI has advised over 60 companies, completing more than 70 projects in the past year categorized into three groups as follows

- Companies currently undergoing in-house training to prepare for carbon footprint assessment.

- Companies in the process of data preparation and assessment for registration.

- Companies that have completed the assessment and successfully registered their carbon footprint.

If you are looking for a consultant to help drive your business toward sustainable growth, we are the right choice for you. Our services are provided by a team of expert engineers at standardized rates, with a proven track record of registered successful projects. Contact us now!

Contact Us

- Facebook : FDI Group – Business Consulting

- @fdigroup

- Phone : 02-642-6866, 02-642-6869, 02-642-6895

- E-mail : infojob@fdi.co.th

- Website : www.fdi.co.th

BlogArticles

ธุรกิจกับผู้บริโภค จะสร้างการมีส่วนร่วมลดคาร์บอนฟุตพริ้นท์อย่างไร ?

ในยุคที่วิกฤตการเปลี่ยนแปลงสภาพภูมิอากาศ (Climate Change)...

Read MoreThailand Taxonomy คืออะไร ? มาตรฐานใหม่สู่สังคมคาร์บอนต่ำ

เคยสงสัยกันหรือไม่ ? ว่าการดำเนินงานด้านสิ่งแวดล้อมของแต่ละธุรกิจดำเนินการกันจริงจังหรือทำเพื่อกล่าวอ้าง...

Read MoreCarbon Label หรือ ฉลากคาร์บอนฟุตพริ้นท์ในไทยมีแบบไหนบ้าง ต่างกันอย่างไร ?

Carbon Label คืออะไร...

Read More